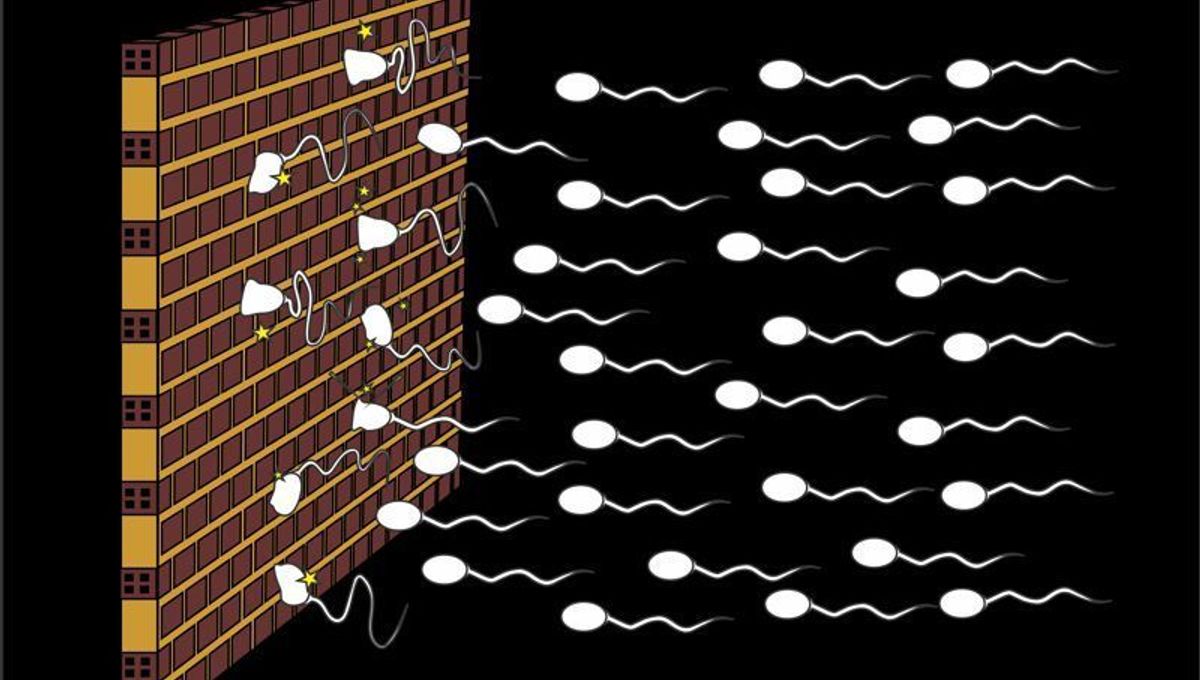

Former President Donald Trump’s threats to impose tariffs if re-elected are stirring concerns among investors and global markets, casting uncertainty over the United States’ position as a premier destination for foreign investment.

During his first term in office, Trump’s trade policies—especially the implementation of tariffs on imports from key partners such as China and the European Union—created volatility in international markets. Now, as he campaigns for a return to the presidency in 2024, his renewed promises of aggressive trade measures are again causing hesitation among global investors.

Economic analysts warn that increased tariffs could provoke retaliatory actions from trading partners, disrupt supply chains, and ultimately reduce the attractiveness of the U.S. market for foreign companies and investors. This uncertainty could jeopardize future investment flows, which are key to maintaining economic growth and innovation.

While the U.S. has long been considered a stable and favorable environment for business, Trump’s protectionist rhetoric is prompting some multinational firms to consider diversifying their investments into other markets with fewer risks. Economists and business leaders are closely monitoring developments to assess how potential policy shifts may impact the investment landscape going forward.

As the 2024 election approaches, the prospect of Trump enacting significant trade barriers remains a crucial issue for both domestic and international stakeholders, with potential long-term implications for the U.S. economy.

Source: https:// – Courtesy of the original publisher.