For much of the last ten years, a small group of high-performing technology companies—often dubbed ‘Big Tech’—have propelled the U.S. stock market to unprecedented highs. These firms not only transformed industries but also became essential components of investment portfolios worldwide, appealing to both institutional and retail investors.

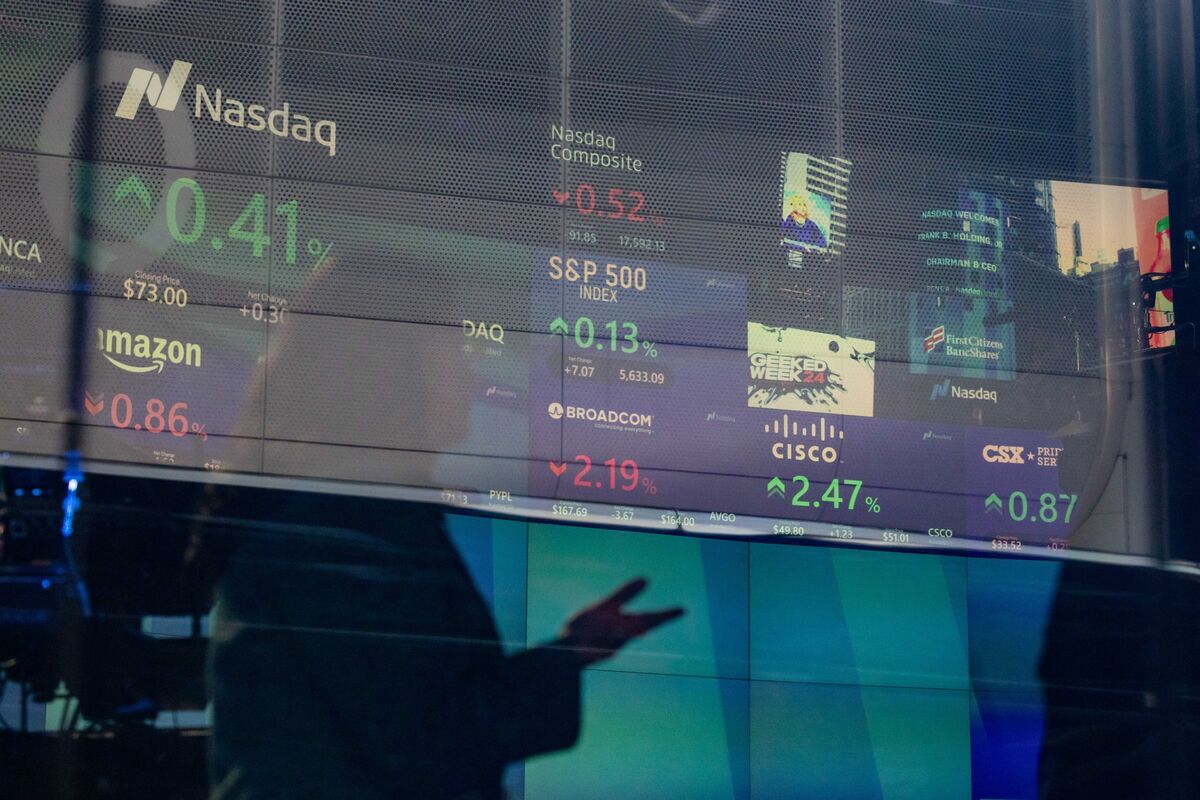

This dominance, however, has shown signs of unraveling in 2024. The sharp decline in the share prices of several major tech stocks has eroded much of the gains that have characterized the sector’s long-running bull market. Contributing factors include rising interest rates, increased regulatory scrutiny, and slowing revenue growth as consumer and enterprise demand stabilizes following the pandemic-driven digital boom.

Investors are now reassessing the premium valuations that had been assigned to tech firms given their previous growth trajectories. Market analysts note that while technology remains a critical sector of the economy, its once-unquestioned leadership in the stock market is no longer a certainty. Broader diversification and rotation into other sectors—such as energy, industrials, and consumer staples—have emerged as alternative strategies among investors seeking stability in a more volatile market environment.

As the landscape evolves, industry leaders are under mounting pressure to demonstrate sustainable growth and innovation in a climate marked by economic uncertainty and heightened competition. The coming quarters are likely to be pivotal in defining whether this shift away from technology is a temporary realignment or a long-term transformation of the global investment paradigm.

Source: https:// – Courtesy of the original publisher.