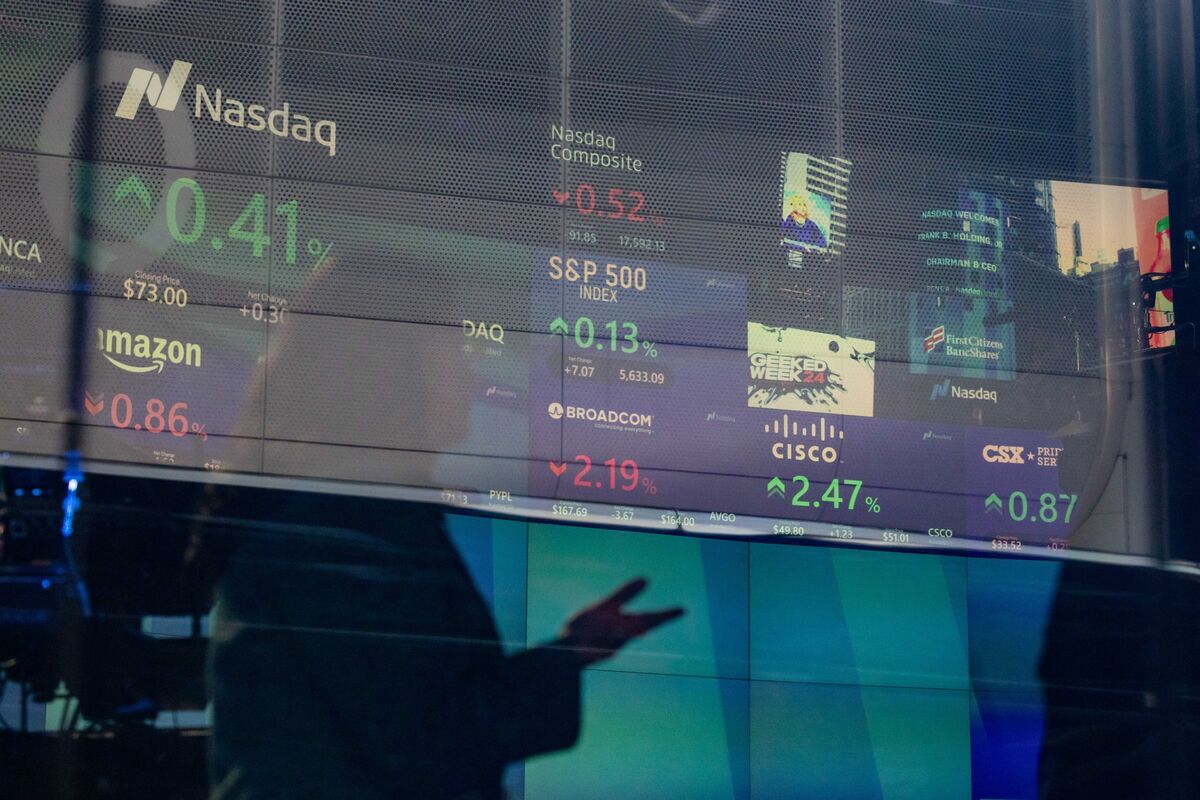

The S&P 500 index is currently trading 3% below its all-time high reached in mid-February, a drop that economic analysts attribute in part to the resurgence of global trade tensions. The decline coincided with the initiation of a fresh round of trade measures implemented by former President Donald Trump, who reintroduced tariffs on key U.S. trading partners, beginning with Canada and Mexico.

In February, the Trump administration announced a series of tariffs on a variety of imported goods, signaling the start of what some experts are calling a renewed global trade war. The initial targets of these measures were neighboring allies, with Canada and Mexico being the first to face import penalties. As a result, investor confidence wavered, decreasing appetite for risk and triggering a modest pullback in the equities market.

Market strategists point to uncertainty around the long-term consequences of trade disputes as a key driver in the S&P 500’s recent underperformance. Although corporate earnings have generally remained strong, fears of retaliatory tariffs and disrupted supply chains have intensified variability in investor sentiment.

Economists caution that sustained trade-related policy changes could hinder global economic growth and potentially prompt more companies to reassess their international strategies. Some sectors, such as manufacturing and technology, may be particularly vulnerable due to their reliance on transnational supply lines.

As the market adjusts to evolving geopolitical dynamics and trade policies, analysts will be carefully watching upcoming data releases and corporate guidance to assess how much of an impact these measures will ultimately have on financial markets and broader economic health.

While the S&P 500 remains within striking distance of its prior peak, continued volatility is expected as markets digest the implications of imposed and retaliatory tariffs. Observers stress that resolution or de-escalation of trade conflicts will be key to restoring confidence and pushing the index back toward record levels.

Source: https:// – Courtesy of the original publisher.