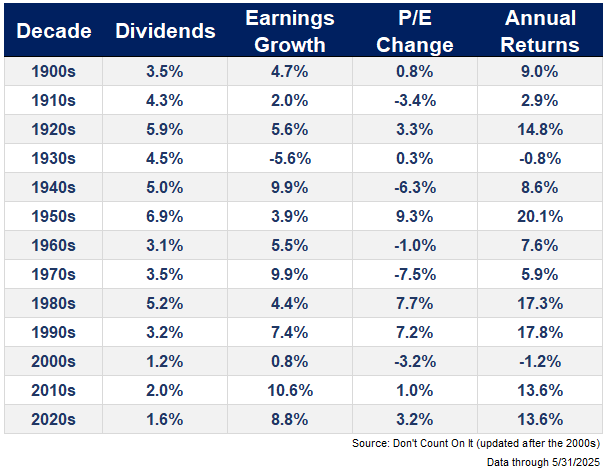

As investors navigate an increasingly uncertain economic landscape, the Bogle Expected Return Formula, popularized by Vanguard founder John C. Bogle, continues to serve as a useful tool for projecting long-term stock market returns. The formula, which factors in dividend yield, earnings growth, and changes in valuation, offers a conservative estimate of what investors might expect from equities over a 10-year horizon.

In its basic form, the Bogle Expected Return Formula is expressed as:

Expected Return ≈ Dividend Yield + Earnings Growth ± Change in Valuation (P/E Ratios).

This framework helps demystify the complex relationships between current market conditions and expected future returns. With dividend yields remaining historically low—generally below 2% for major U.S. indices—and earnings growth expected to moderate following a post-pandemic surge, valuations play a significant role in the overall outlook.

Currently, equity markets are trading at elevated price-to-earnings (P/E) ratios compared to historical norms. If valuations revert to their long-term averages, this would subtract from future returns, suggesting a more subdued outlook for equity gains. On the other hand, if high valuations persist or expand further, they could inflate future returns—but with increased risk.

Historically, when valuations have been high, the Bogle-style method has anticipated modest average annual returns, often in the range of 4–6%, including dividends. Conversely, when markets were undervalued, return expectations soared accordingly.

While no model can predict market outcomes with absolute certainty, the Bogle Expected Return Formula offers investors a disciplined perspective rooted in fundamental market drivers. It encourages long-term thinking and prudence, particularly in times of elevated asset prices.

As investors reflect on portfolio strategy in the current environment, tools like Bogle’s formula provide valuable insight for setting realistic expectations and managing risk in the pursuit of financial goals.

Source: https:// – Courtesy of the original publisher.