Wall Street’s leading financial institutions have reported record levels of trading revenue, reflecting robust market activity and investor engagement despite widespread concerns over tariffs and the broader economic climate. According to data released this week, major banks have outperformed expectations, benefiting from heightened market volatility and sustained volume trading.

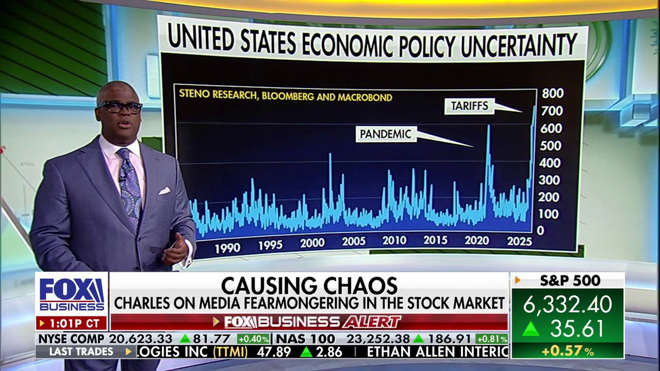

Charles Payne, host of ‘Making Money,’ highlighted the surprising revenue gains amid what he described as a ‘doom and gloom’ sentiment surrounding tariffs. Analysts attribute the strong financial performance to a combination of factors, including steady demand for investment services, increased institutional trading, and agile strategies that capitalize on shifting market dynamics.

The record-breaking figures underscore Wall Street’s adaptability in navigating geopolitical uncertainty and show resilience in the financial services sector. While ongoing trade disputes and tariff concerns continue to loom over global markets, the performance of major banks suggests a capacity to weather such disruptions effectively.

Industry experts caution, however, that long-term sustainability will depend on broader economic trends and policy decisions. As central banks weigh interest rate strategies and governments negotiate trade deals, financial institutions remain vigilant in managing risk and maintaining liquidity.

Overall, the latest earnings reports provide a cautiously optimistic outlook for the financial sector, with continued growth opportunities as markets adapt to changing global conditions.

Source: https:// – Courtesy of the original publisher.