A recently reached trade agreement between the United States and China has provided a sense of relief for investors concerned about the potentially severe economic impact of high tariffs. The agreement comes after escalating tensions had led to fears that tariffs as steep as 145% would be imposed, raising prices for consumers and potentially disrupting key sectors of bilateral trade.

The pact is seen as a significant diplomatic and economic development, signaling a slowdown in trade hostilities between the world’s two largest economies. Analysts suggest the avoidance of such drastic tariffs could help stabilize financial markets that have been jittery over trade uncertainty and rising inflationary pressures.

Details of the deal have not been fully disclosed, but preliminary reports indicate that it includes measures aimed at improving market access, intellectual property protections, and a more transparent regulatory environment. These commitments are expected to facilitate continued trade flows in critical industries such as technology, agriculture, and manufacturing.

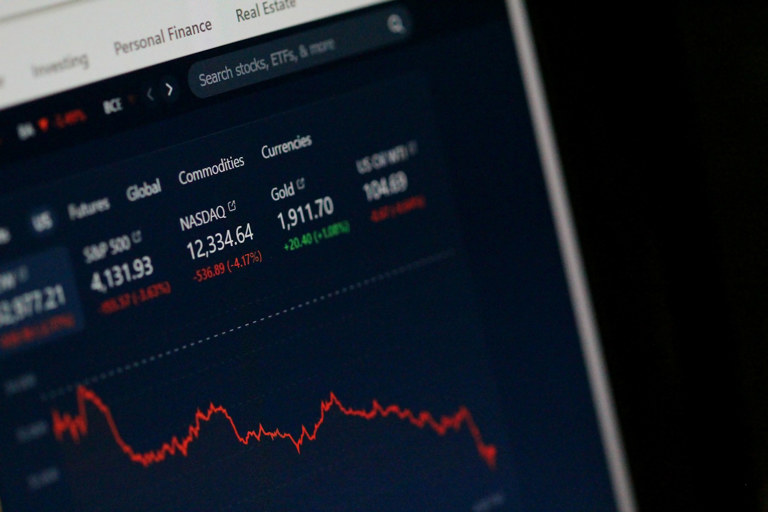

Investors responded positively to the announcement, with major stock indexes experiencing gains shortly afterward. Economists note that by averting the implementation of sharply higher tariffs, both countries have helped maintain global economic stability and reduced the risk of a broader slowdown.

The development is particularly timely as governments and central banks around the world navigate inflation management, supply chain disruptions, and post-pandemic recovery efforts. Stakeholders are cautiously optimistic that this agreement might pave the way for more sustained cooperation between Washington and Beijing.

Overall, the agreement represents a de-escalation in trade tensions and a hopeful sign for future economic and diplomatic relations between the two nations.

Source: https:// – Courtesy of the original publisher.