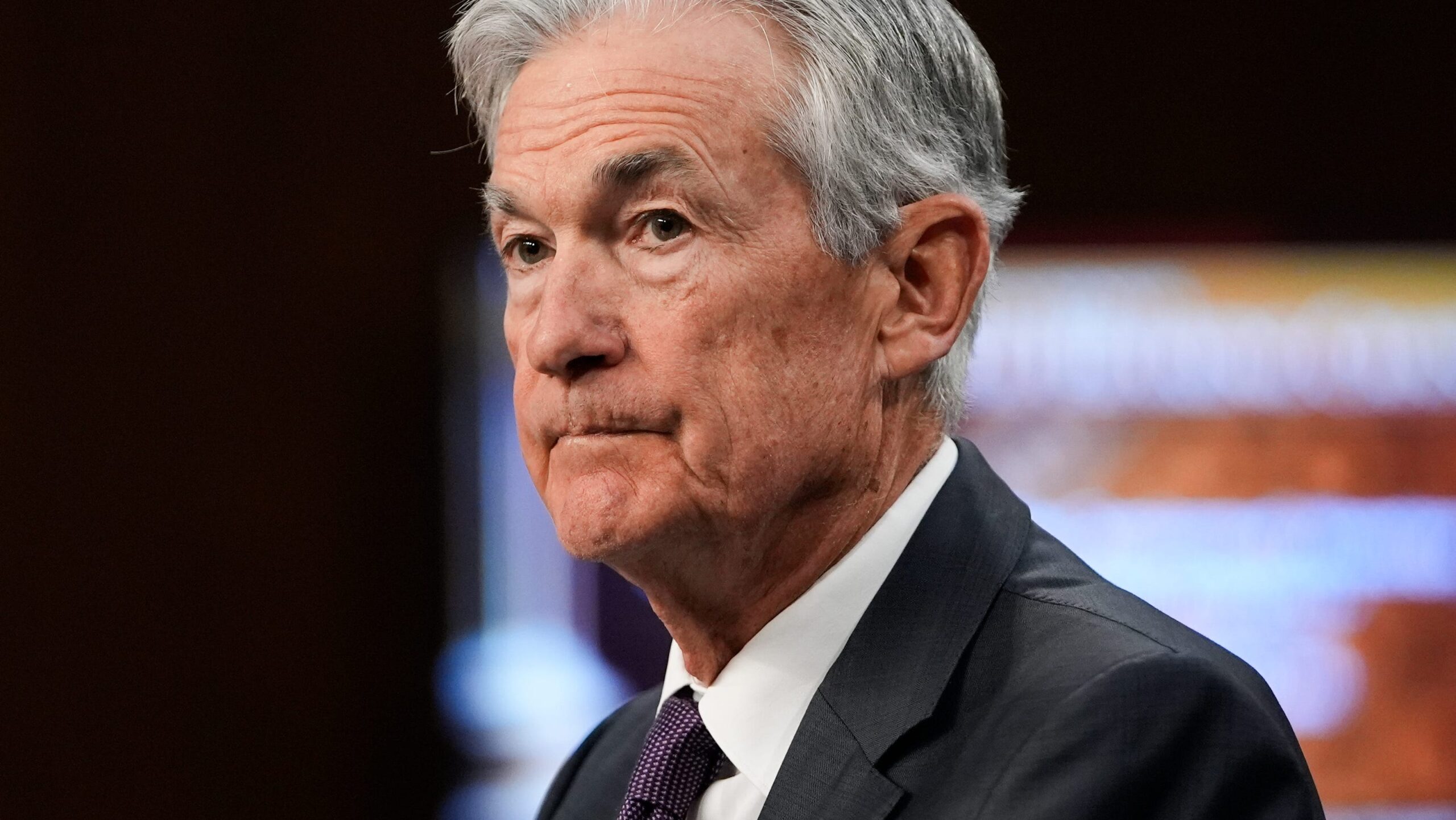

President Donald Trump on Wednesday intensified his criticism of Federal Reserve Chair Jerome Powell, further escalating tensions between the White House and the nation’s central banking authority. The public rebuke has raised concerns among investors and economists about the independence of the Federal Reserve and the potential implications for monetary policy.

In recent months, Trump has repeatedly voiced dissatisfaction with the Fed’s decisions on interest rate policy, accusing Powell of failing to support robust economic growth through monetary easing. This latest round of criticism appears to sharpen the president’s stance, suggesting a more confrontational approach as economic and political pressures mount.

Financial markets have reacted cautiously to Trump’s remarks, with some investors worried that overt political pressure on the Federal Reserve could undermine its ability to make impartial decisions aimed at promoting economic stability and curbing inflation. Analysts warn that any perceived loss of the Fed’s autonomy could inject volatility into both domestic and global markets.

Jerome Powell, who was appointed by Trump in 2018, has maintained that the Fed’s decisions are driven by economic data and long-term objectives, not political influences. Despite repeated attacks, Powell has signaled his commitment to preserving the institution’s independence.

The episode marks another chapter in the continuing tug-of-war between the White House and the Federal Reserve, one that may have far-reaching consequences for the U.S. economy, investor confidence, and global financial stability as the 2024 presidential election approaches.

Source: https:// – Courtesy of the original publisher.