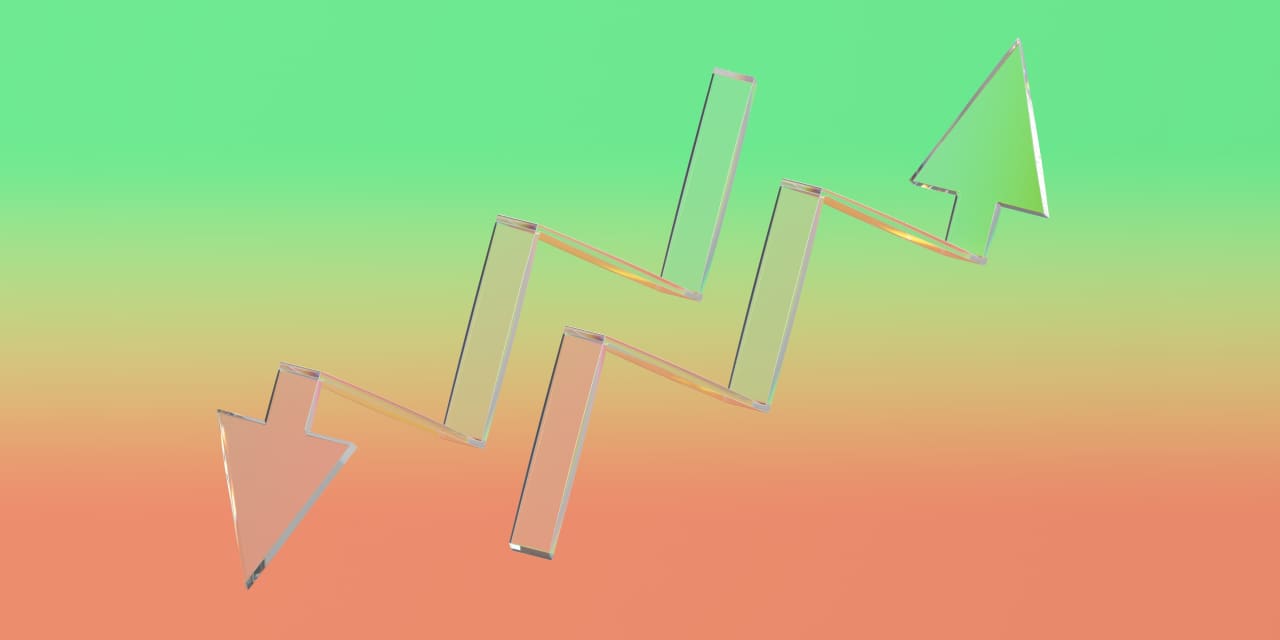

U.S. stock futures rose early Wednesday as investors anticipated an upcoming announcement on auto tariffs from President Donald Trump, coupled with a busy slate of corporate earnings reports.

Futures tied to the Dow Jones Industrial Average, S&P 500, and Nasdaq 100 all traded higher in premarket activity, signaling a potentially positive start for Wall Street.

Market attention is focused on the possible implementation of tariffs on imported automobiles, a move that could affect major carmakers and global trade dynamics. The White House has not yet confirmed the details of the tariff package, but the industry and investors remain alert for its potential economic impact.

Meanwhile, the market continues to navigate through the thick of earnings season. Several major companies across sectors are scheduled to release quarterly results today, providing further insight into the state of the U.S. economy and corporate performance amid persistent inflationary pressures and interest rate expectations.

Investors are balancing positive sentiment from strong earnings outlooks with ongoing caution about geopolitical developments and domestic economic policy shifts. The combination of earnings data and trade policy decisions is expected to set the tone for the trading day.

Source: https:// – Courtesy of the original publisher.