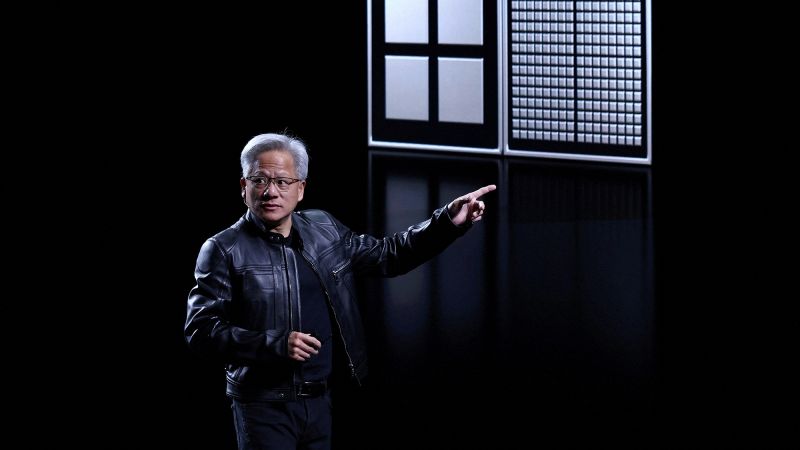

Nvidia, the US-based semiconductor giant, announced it will no longer include China in its revenue and profit forecasts due to stringent US export restrictions on high-end chip sales to the country. CEO Jensen Huang confirmed the move during a public statement on Thursday, underscoring rising tensions in the global technology sector driven by geopolitical and security concerns.

The restrictions, initially imposed by the Biden administration in 2022 and later expanded, aim to curb the transfer of advanced semiconductor technologies that could enhance China’s military capabilities. These regulations have directly impacted US companies like Nvidia, which previously counted China as one of its major markets for graphics processing units (GPUs) and other high-performance chips.

“Given these new export controls, we are not counting on any meaningful contribution from China in our future financial outlooks,” Huang said. Nvidia’s decision reflects both the loss of a major market and the broader uncertainty that export controls have introduced into global supply chains and international sales strategies for U.S. chipmakers.

Prior to the restrictions, Nvidia had developed special versions of its AI-focused chips tailored to comply with earlier regulatory limits, hoping to maintain Chinese market access. However, with the tightened rules, even these limited-function chips are now subject to bans. The latest measures have prompted Nvidia and similar companies to reallocate resources and focus on other key markets.

Despite the setback, Nvidia continues to see strong demand for its AI and data center products in other parts of the world, especially amid the booming interest in generative AI technologies. The company’s stock has experienced substantial gains over the past year, fueled by widespread adoption of Nvidia hardware across industries.

Huang indicated Nvidia remains committed to compliance with all US laws and believes innovation and demand in non-restricted regions will continue to drive growth. However, the exclusion of China—a market that contributed significantly to past revenues—marks a profound shift in the company’s global strategy in response to the evolving geopolitical landscape.

Source: https:// – Courtesy of the original publisher.