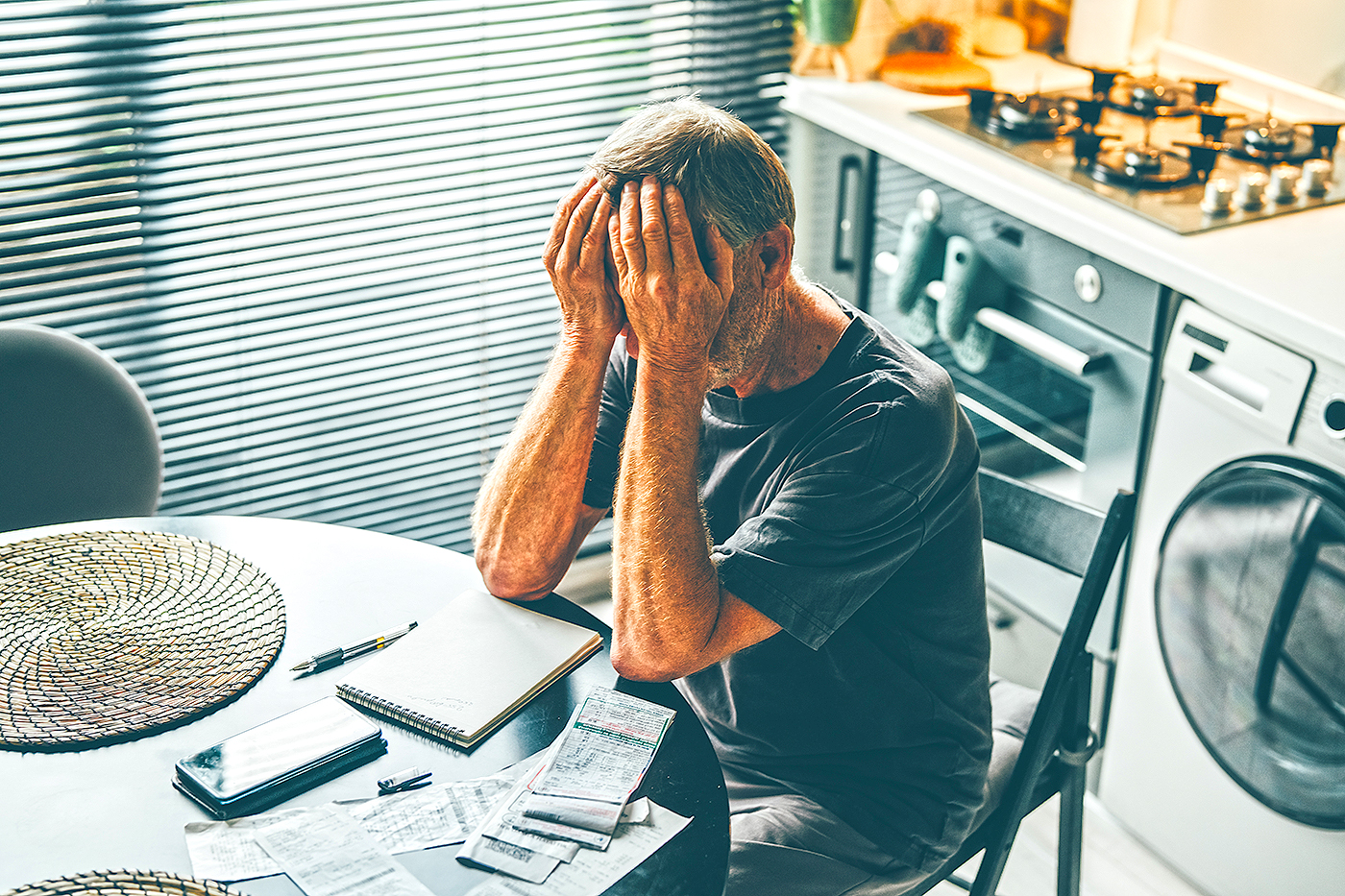

With inflation continuing to be a major economic concern, many Americans planning for or currently in retirement are becoming more anxious about the erosion of their purchasing power. Inflation, the general rise in prices over time, can significantly reduce the value of fixed income and savings—key sources on which many retirees rely.

Historically, inflation has hovered around 2-3% annually, but in recent years, it has surged higher, pushing consumers to reassess their financial plans. For retirees living on a fixed income, this can be particularly damaging: the money they set aside in retirement accounts such as IRAs or 401(k)s may not stretch as far as originally planned.

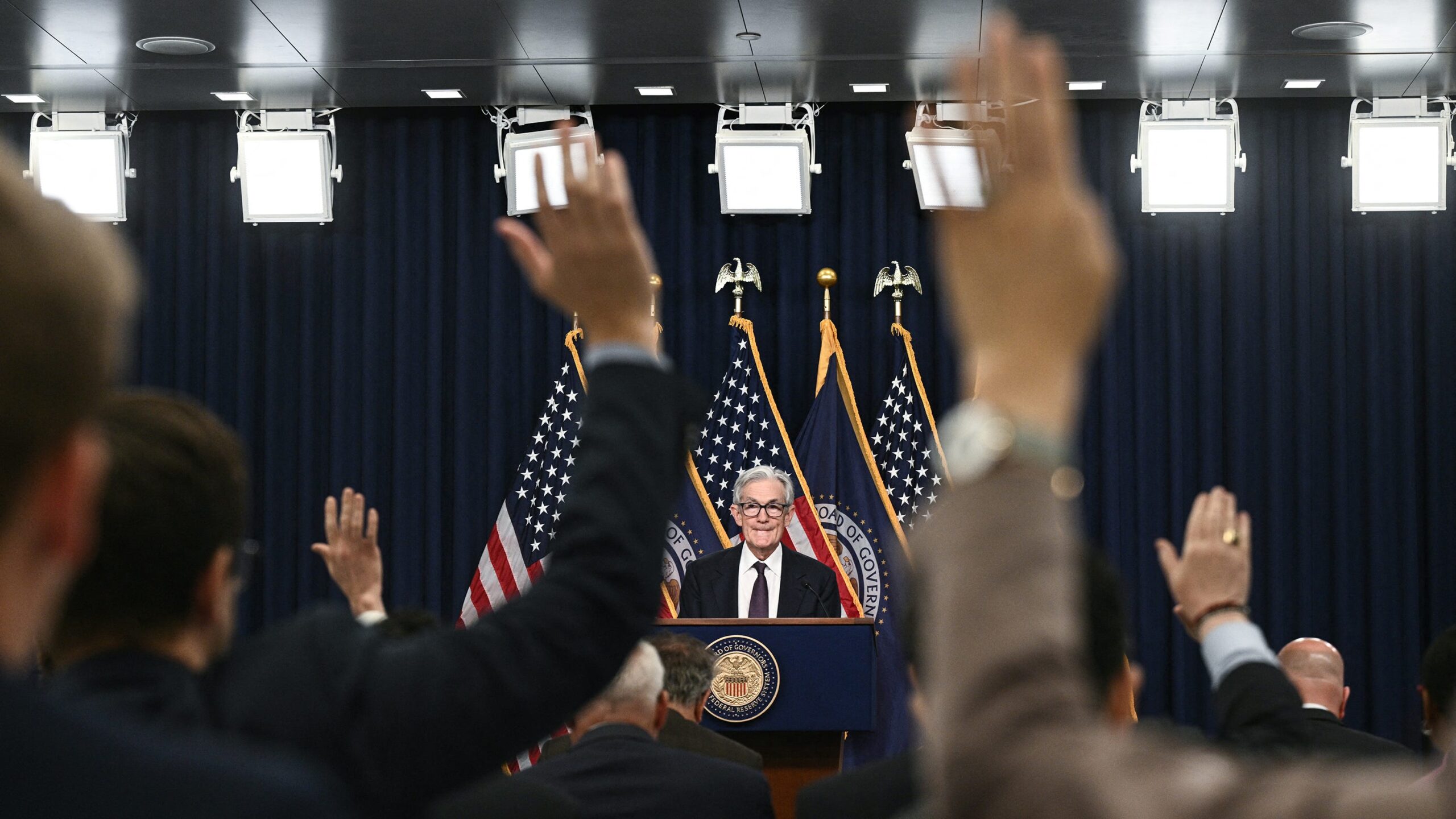

Financial experts advise that addressing inflation risk should be a central part of retirement planning. Strategies can include:

1. **Investing in inflation-protected securities:** These include Treasury Inflation-Protected Securities (TIPS), which increase in value with inflation and provide a hedge against rising prices.

2. **Maintaining a diversified portfolio:** A mix of equities, bonds, and real estate can help ensure assets grow over time, offsetting the impact of inflation.

3. **Delaying Social Security benefits:** By postponing the start of Social Security, retirees can receive higher monthly benefits that adjust with inflation.

4. **Reassessing lifestyle and spending plans:** Retirees may need to revisit their budgets and adjust discretionary spending to account for rising costs.

5. **Working with a financial advisor:** A professional can help map out individualized strategies that take inflation and other economic risks into account.

While inflation presents a serious challenge, especially over the course of a multi-decade retirement, thoughtful planning and smart investment choices can provide some defense. For those approaching retirement, it’s crucial to create a flexible plan that anticipates a range of economic conditions, including persistent inflation.

Source: https:// – Courtesy of the original publisher.