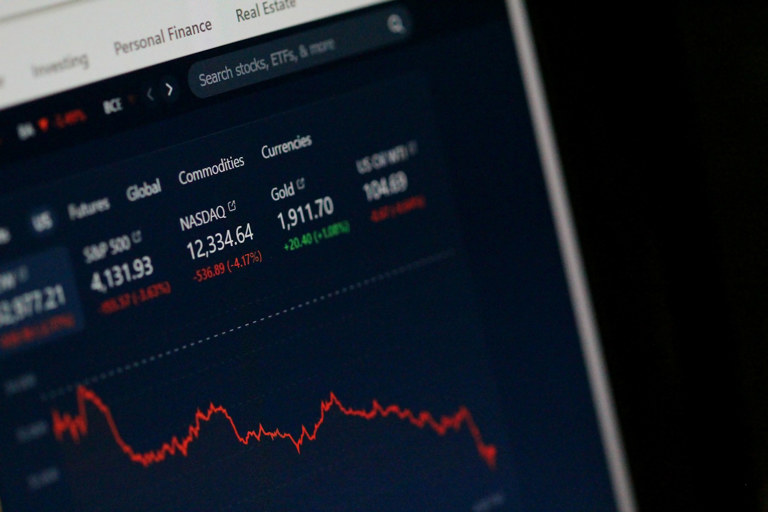

Gold prices have been hitting record highs, underscoring growing investor interest in safe-haven assets amid ongoing economic and policy uncertainty in the United States. The precious metal’s strong performance reflects broader concerns about the stability of financial markets as well as potential shifts in U.S. monetary strategy.

Several key factors are contributing to gold’s surge. Market participants are increasingly cautious about inflation trends, interest rate forecasts, and geopolitical tensions, prompting a shift toward more stable investments like gold. The metal’s upward momentum is being seen as a hedge against volatility and potential downturns in the broader economy.

As a traditional store of value, gold benefits during periods of economic stress, and recent developments both in domestic policy discussions and global markets have reinforced its appeal. Analysts suggest that if current trends continue, gold could see further upside, especially if investor sentiment remains risk-averse.

This sustained rise in gold’s valuation highlights its enduring role as a critical component of diversified investment strategies in times of financial uncertainty.

Source: https:// – Courtesy of the original publisher.