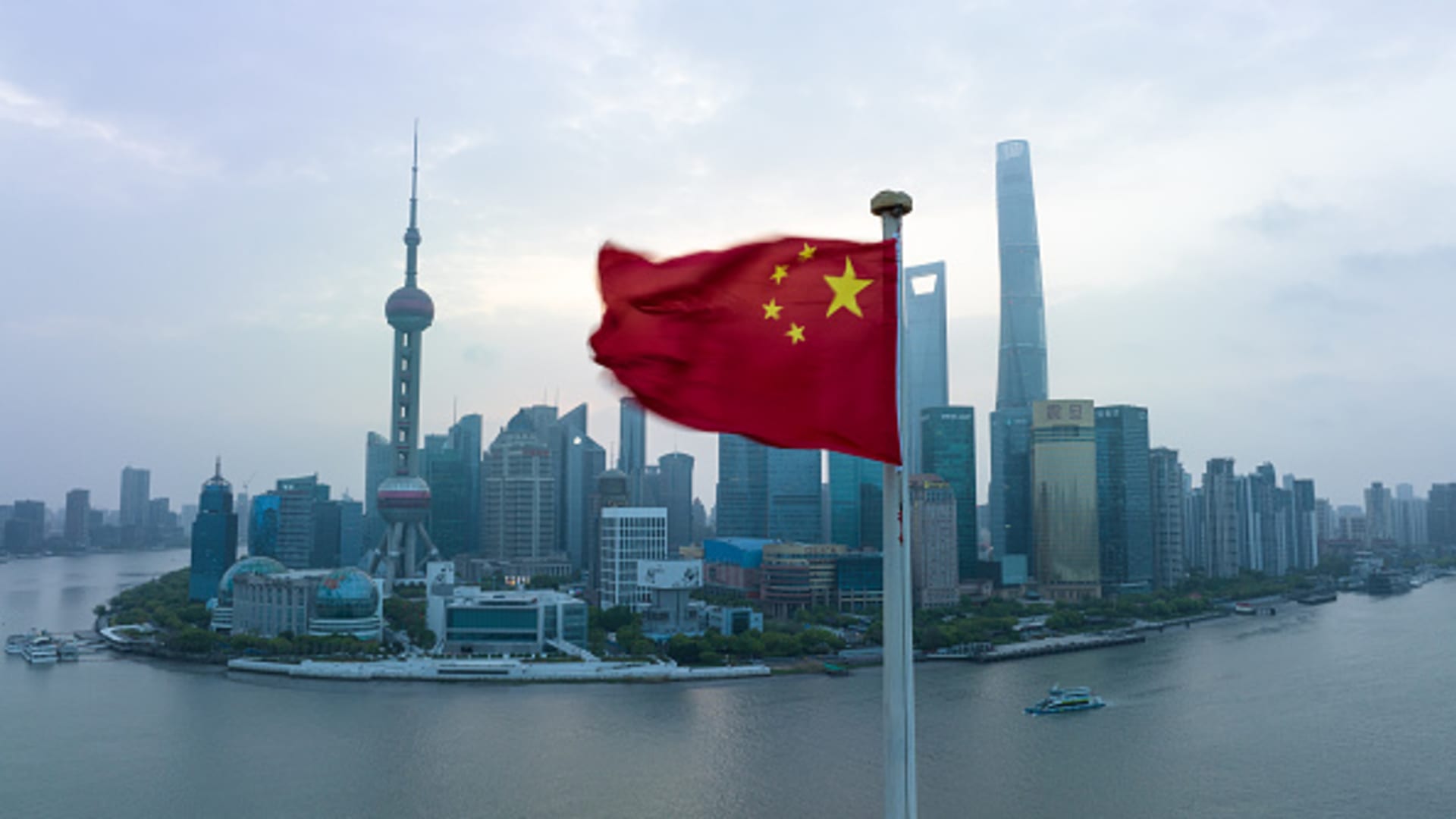

Global financial institutions are reevaluating their positions on China as diplomatic and trade relations between the United States and China show signs of warming. This shift comes after a prolonged period of tension that weighed heavily on investment sentiment and economic forecasts for the world’s second-largest economy.

The recalibration in outlooks is fueled by recent diplomatic engagements and policy discussions aimed at reducing friction over trade, technology access, and geopolitical alignment. Several major global banks, including JPMorgan Chase, Goldman Sachs, and UBS, have signaled a more optimistic stance toward Chinese markets, citing improved policy clarity and stabilizing macroeconomic indicators.

These reassessments mark a notable turnaround from earlier in the year when many financial institutions downgraded their expectations due to concerns over China’s sluggish post-pandemic recovery, policy unpredictability, and regulatory crackdowns on key sectors.

Analysts say the latest developments could attract renewed investor interest in Chinese assets, particularly in sectors such as green energy, technology, and consumer goods. However, they also caution that lingering structural challenges—such as high youth unemployment and a fragile property sector—must be addressed to sustain long-term investor confidence.

The evolving geopolitical landscape underscores the importance for investors and financial institutions to closely monitor policy signals and economic data as they adjust their strategies in response to changing international dynamics.

Overall, the shift in global banks’ outlooks reflects growing hope that a more constructive phase in U.S.-China relations could bolster China’s economy and open up new investment opportunities across Asia.

Source: https:// – Courtesy of the original publisher.