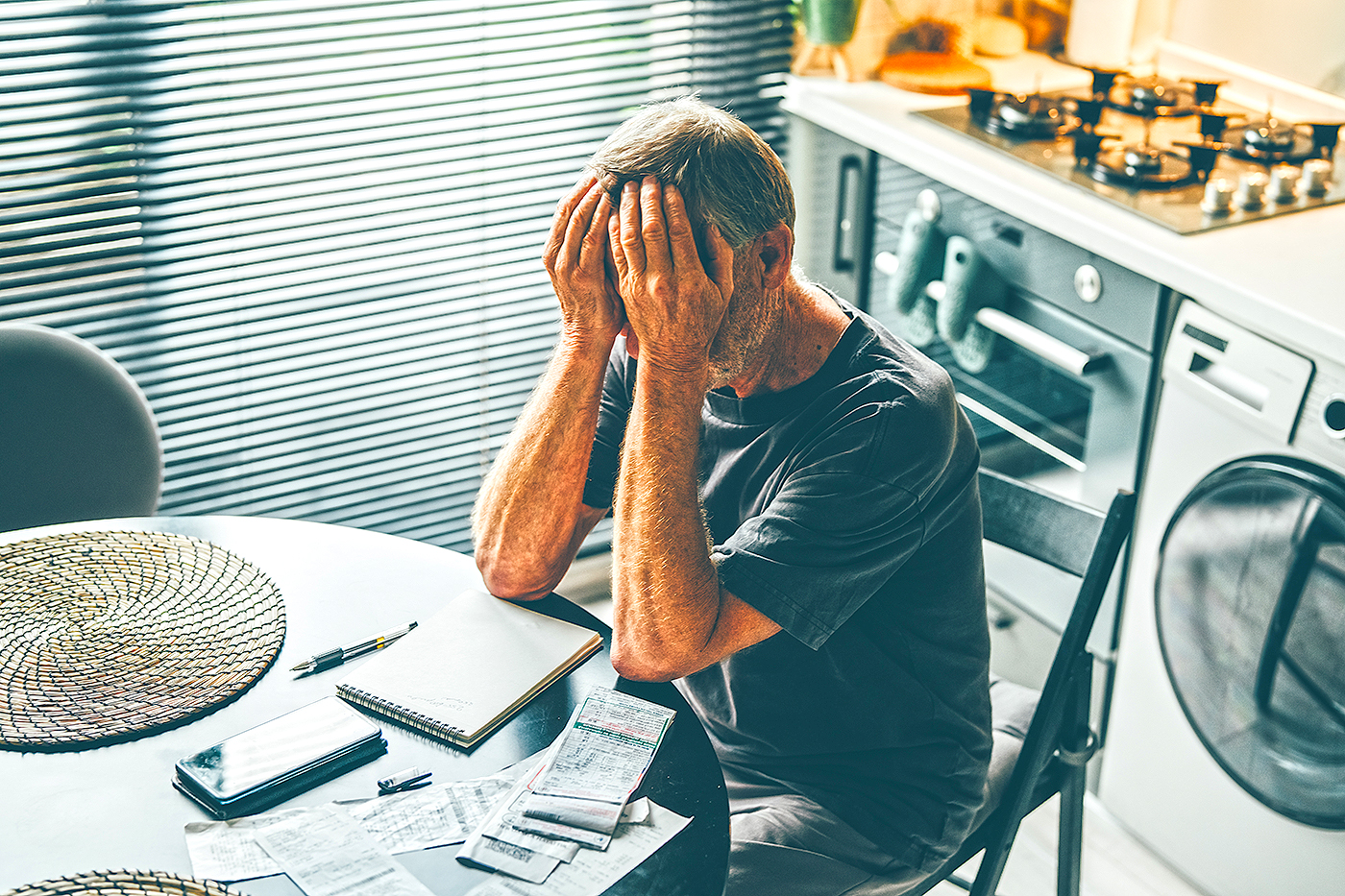

Investing and financial decisions often come with considerable emotional highs and lows, and for many Americans, this financial stress is taking a toll on their mental health. According to a recent survey, 43% of Americans report that money has a negative impact on their mental health at least occasionally.

This statistic underscores a broader trend in the intersection between personal finance and emotional well-being. The volatility of markets, job uncertainty, inflation, and debt are some of the key stressors contributing to financial anxiety. These challenges are especially relevant in an era where more individuals manage their retirement and investment strategies independently, often without professional guidance.

Mental health professionals note that persistent financial stress can lead to a cycle of worry, affecting sleep, mood, and even relationships. Likewise, financial advisors are seeing an increased need to address not just the numbers but also the emotional well-being of their clients.

Experts suggest several strategies to mitigate this stress, including setting realistic financial goals, maintaining a well-balanced portfolio, seeking professional financial advice, and practicing mindfulness or stress-reduction techniques. As financial concerns continue to be a significant factor in mental health, both individuals and institutions may need to pay closer attention to how money-related stress is managed in daily life.

Ultimately, acknowledging the emotional component of investing and seeking support when needed can help promote not only financial stability but also a healthier state of mind.

Source: https:// – Courtesy of the original publisher.