European stock markets showed little movement on Tuesday as investors digested news of newly proposed U.S. tariffs aimed at a number of foreign nations. The muted performance came amid broader concerns about how trade tensions could impact global economic growth.

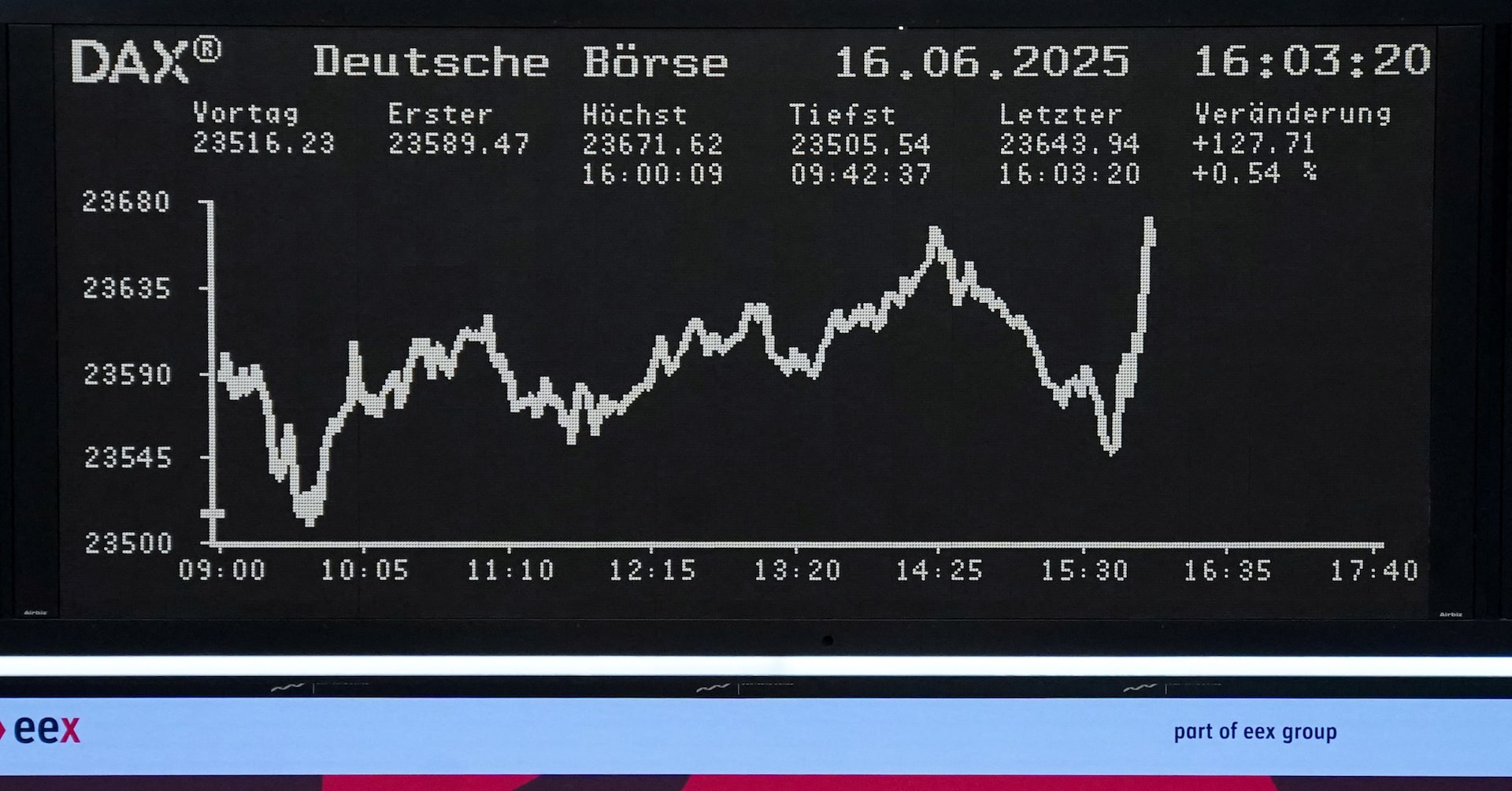

Markets across major European indices, including the FTSE, DAX, and CAC, remained relatively flat during trading hours, reflecting investor caution. The restrained trading mood followed the announcement by U.S. President Donald Trump of potential new tariffs on a group of countries, though specific targets and goods were not fully detailed.

Analysts indicated that market participants were awaiting further clarity on the scope and implementation of the proposed tariffs before making significant investment decisions. Many investors are concerned that escalating protectionist measures may disrupt trade flows and supply chains, which could, in turn, dampen global economic activity.

The reaction in Europe mirrors a broader trend in global financial markets, where equities have experienced heightened volatility due to shifting policies and geopolitical events. Traders remain tuned to upcoming economic data releases and official statements from U.S. trade representatives for better insight into the administration’s next steps.

In the meantime, European business sectors with significant exposure to global trade, such as automotive and industrials, are preparing contingency strategies in case the U.S. measures lead to retaliatory actions or impact trading volumes.

As global trade dynamics continue to evolve, market watchers caution that prolonged uncertainty could weigh on investor confidence and corporate investment decisions in the coming months.

Source: https:// – Courtesy of the original publisher.