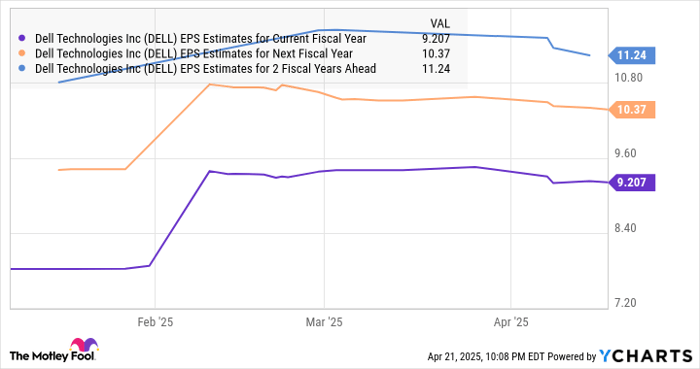

Dell Technologies (NYSE: DELL) is off to a challenging start in 2025, with its stock dropping 28% year-to-date. The decline comes as investors respond to lukewarm quarterly results and increasing uncertainty surrounding global trade conditions.

The technology firm, known for its servers, personal computers (PCs), and other computing peripherals, is facing headwinds from the potential fallout of the Trump administration’s imposition of ‘reciprocal’ tariffs. With Dell’s manufacturing and supply chain extending globally, escalating trade tensions pose a risk to its cost structure and product pricing.

Analysts note that while Dell remains a key player in the IT hardware market, reduced consumer and enterprise spending, compounded by geopolitical pressures, could weigh on its performance in the near term. The company’s prospects may hinge on how effectively it adapts to the evolving trade environment and navigates operational challenges across its international footprint.

Source: https:// – Courtesy of the original publisher.