Ark Invest, the investment management firm led by CEO and Chief Investment Officer Cathie Wood, has been actively increasing its exposure to semiconductor companies in recent months. Notably, Advanced Micro Devices (AMD) and Taiwan Semiconductor Manufacturing Company (TSMC) have emerged as significant positions in the firm’s portfolio.

Known for her focus on innovative and disruptive technologies, Wood has traditionally emphasized sectors like genomics, artificial intelligence, and cryptocurrencies. However, the recent uptick in Ark Invest’s allocations to chip stocks signals a strategic adjustment that acknowledges the critical role of semiconductors across virtually all modern technologies, including those industries previously favored by the firm.

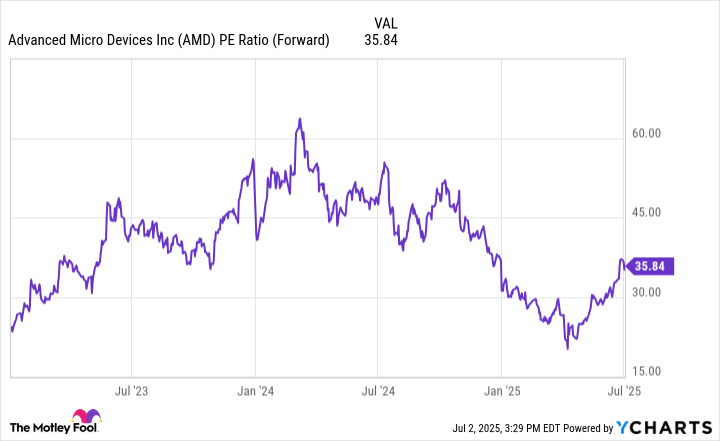

AMD, a major producer of central processing units (CPUs) and graphics processing units (GPUs), has seen increased institutional interest due to its competitive developments in AI and high-performance computing chips. TSMC, one of the world’s leading semiconductor manufacturers, serves as a key supplier to global tech companies and continues to benefit from the swelling demand for chips required in smartphones, data centers, automotive systems, and advanced machine learning applications.

The new positions reflect Ark Invest’s recognition of long-term growth opportunities in the semiconductor space as global industries digitize and adopt more AI-powered solutions. The firm’s emphasis on AMD and TSMC may also be seen as a hedge against volatility in the more speculative assets the fund is known to back.

This shift comes amid a broader industry trend where semiconductor companies are becoming central to investment strategies across Wall Street, driven by the global AI boom and rising demand for advanced computing hardware.

While Ark Invest continues to hold firm on disruptive innovation, the growing prominence of established chip stocks in its portfolio highlights a more nuanced approach to balancing growth potential with foundational technological infrastructure.

Source: https:// – Courtesy of the original publisher.