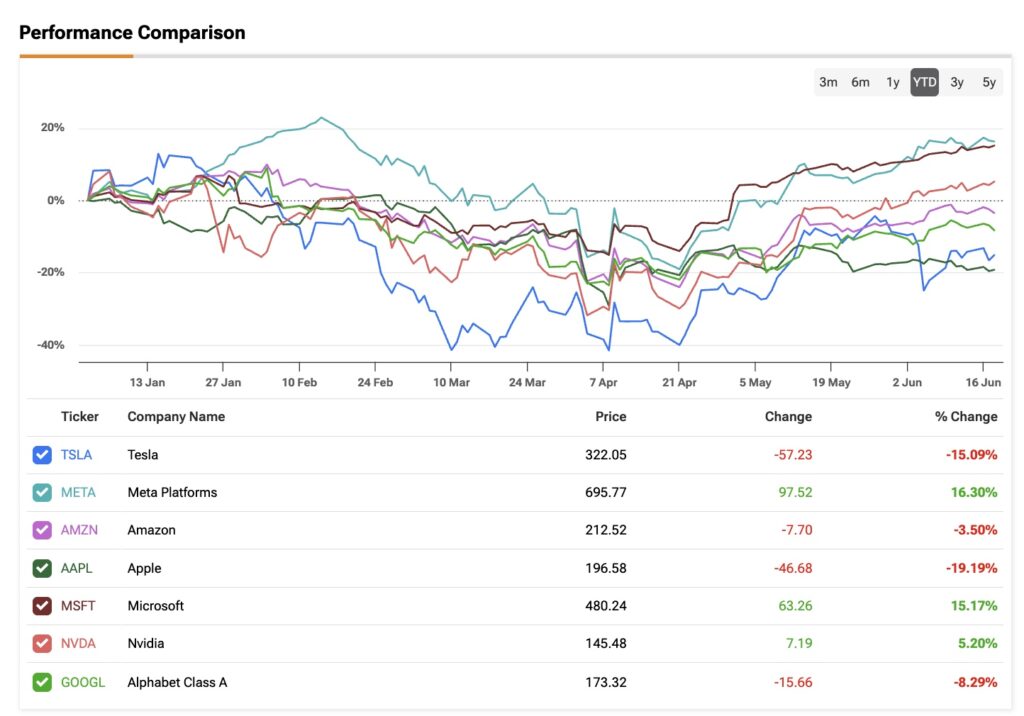

Apple Inc. (NASDAQ: AAPL) has experienced a difficult start to 2025, with its stock trading below the $200 threshold—roughly 25% off its all-time high. This performance has positioned Apple as the weakest performer among the top seven major technology stocks, marking a stark contrast to the company’s strong historical showing, which averaged 22% total annualized returns over the past decade.

Several macroeconomic and company-specific factors are contributing to Apple’s recent stock decline. Notably, elevated import fees are affecting the company’s product margins, reducing profitability across key hardware lines such as iPhones, iPads, and MacBooks. At the same time, persistently high interest rates are exerting broader pressure on consumer spending and investor sentiment, creating headwinds for Apple and other firms dependent on discretionary tech purchases.

The current environment stands in contrast to recent years, when Apple benefited from robust sales growth and favorable macroeconomic conditions. While the company continues to maintain a strong balance sheet and significant cash reserves, analysts have pointed to potential challenges in sustaining profit margins and innovation leadership amidst a tougher global economic climate.

As the year progresses, investors and analysts alike will be closely watching Apple’s next earnings reports and strategic announcements for signs of turnaround or further strain. The company’s ability to navigate global trade dynamics, manage production costs, and drive new product adoption will be key to regaining its former stock price momentum and investor confidence.

Source: https:// – Courtesy of the original publisher.