Saving for retirement can seem daunting, but setting clear investment goals can simplify the process. Building a $1 million portfolio by the time you retire is an achievable target if you start early and invest consistently.

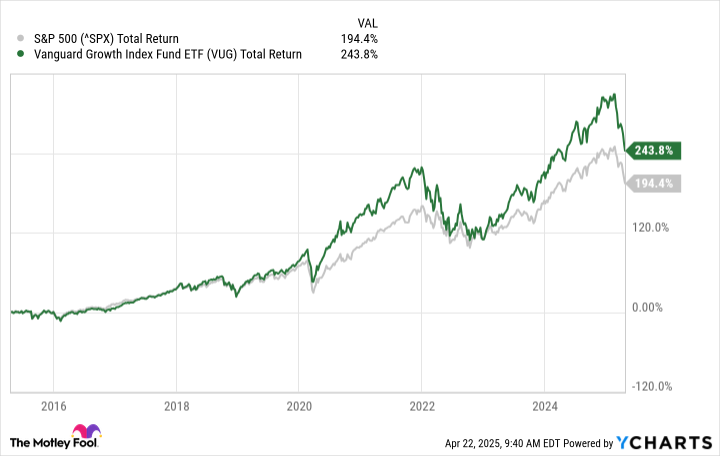

The amount you should invest each month depends on your current age and how many years you have until retirement. Generally, those who start investing early can contribute smaller monthly amounts compared to those who begin later in life. For longer investment horizons, typically 20 years or more, focusing on growth stocks rather than dividend stocks can be a more effective strategy, due to their higher potential for capital appreciation.

Growth stocks are companies expected to increase their earnings at an above-average rate compared to the market. Although they may offer little to no dividend income in the short term, their value can rise significantly over time, providing substantial returns for long-term investors.

By consistently investing and selecting the right portfolio, individuals can position themselves to achieve a million-dollar nest egg by retirement. It’s important to regularly review and adjust your investment plan to stay on track with your financial goals.

Source: https:// – Courtesy of the original publisher.